Both courses offer a variety of learning materials, personalized study plans, and additional resources to assist students in their studies. For information about average CPA fees for your specific state and type of return, we have a handy tool right here. Look for a CPA whose expertise matches your financial situation, verify their credentials, understand their fee structure, and consider their reputation and reviews from other clients. Costs can range widely, from $100 to $200 for simple returns to $500 or more for very complex situations, depending on the factors mentioned above. Many CPAs offer discounts for new clients, loyalty discounts for returning clients, referral discounts, and reduced rates for bundled services.

How Much Does a CPA or Accountant Cost?

- If you prefer a particular billing method, keep that in mind when researching CPAs in your area, and make sure to ask about billing methods before hiring a CPA.

- Before you choose a preparer, ask for a quote on the fees you’ll be charged.

- Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty.

- ”, we are going to take a closer look at the two primary payment methods used by CPAs to determine exactly how much a CPA costs.

- Hiring a good CPA is worth it if your taxes are complex, if you don’t have the patience and skill to do your own taxes, or if you are uncertain about how specific tax laws or changes apply to your situation.

Available to Lili Pro, Lili Smart, and Lili Premium account holders only; applicable monthly account fees apply. All wires are subject to acceptance criteria and risk-based review and may be rejected at the sole discretion of Column Bank N. A. The Lili Visa® Debit Card is issued by Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A., Inc.

Complexity

- An example is Zoho Books, which offers advanced features, such as time tracking and project accounting.

- ”, you’ll get the facts and figures you need in this review and can plan your financial needs accordingly.

- On average, LLCs can expect to pay anywhere from $500 to $2,000 for tax preparation services, with more complex tax situations potentially increasing the cost.

- Any portions of a balance over $100,000 will not earn interest or have a yield.

If you’re unsure whether a CPA is the right choice for you, let’s take a step back and look at the options you have. Since you’re responsible for filing your own taxes, the obligation falls squarely on your shoulders. But you do have a choice as to how to approach it and what methods you want to use. So the price usually will reflect the amount of work needed to prepare them.

Should Small Businesses Use a Tax Preparer?

If you pay around $220, you’ll probably get an average tax preparer who may or may not unearned revenue help you get all the deductions you deserve. But for a little bit more, you can get a trustworthy tax advisor who cares about your situation, helps you understand tax changes, and ensures your tax bill is as low as possible. Hiring a CPA for tax preparation can be justified, as they offer expertise in managing your books, providing accounting consultancy, and reducing tax liabilities. Working with a CPA can save you time, money, and frustration, allowing you to focus on other important business activities. Additionally, a CPA can help you ensure compliance with tax laws and avoid expensive penalties and audits.

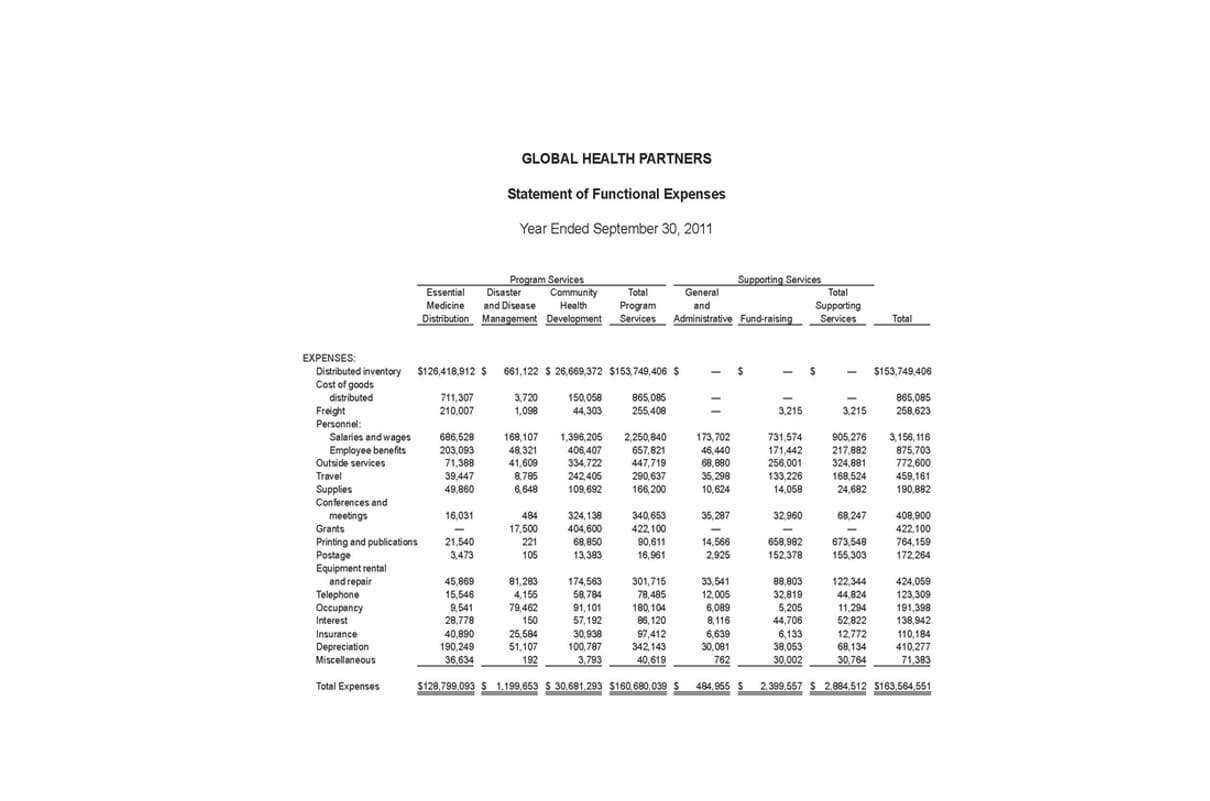

In summary, the cost of maintaining a CPA license includes fees for continuing education and license renewal. CPAs should familiarize themselves with their state’s specific requirements and deadlines to ensure they remain in compliance and continue providing top-notch professional services. Our detailed review how much does a cpa cost of what you can expect to pay in CPA fees covers this exact scenario in the previous section. Based on the section above, you should have a good idea of what the average CPA fees should be based on the firm, location, and experience of your CPA.

How Much Does It Cost to File Taxes With a CPA?

- Tax accountants have extensive knowledge of tax laws, regulations, and deductions, and they can help their clients optimize their tax situation and comply with their tax obligations.

- Whether you decide to work with an accountant or file your taxes independently, the most important thing to remember is to stay organized and keep track of your income and expenses throughout the year.

- Take the next step and learn how to find a small business accountant.

- All wires are subject to acceptance criteria and risk-based review and may be rejected at the sole discretion of Column Bank N. A.

- Most preparers charge a flat fee per return, but some may charge an hourly rate.

Tax strategy involves timing out purchases, structuring your business, deciding when to pay taxes and more to help you save the most in taxes. You can organize your books by reconciling your accounts, correcting your balance sheet and income statement and using accounting software. If a firm’s bookkeeper has to organize your books to do your https://www.bookstime.com/ tax return, then it will probably cost you more. Since those factors make your return more complicated and take more time to get right, CPA firms typically charge more for them. On top of that, many CPAs don’t know what costs might come into play until they actually start doing your return. Here are some of the biggest factors that could increase the cost of working with a CPA firm.

Leave a Reply